ETH Price Prediction: $8K Target in Sight as Institutional Demand Grows

#ETH

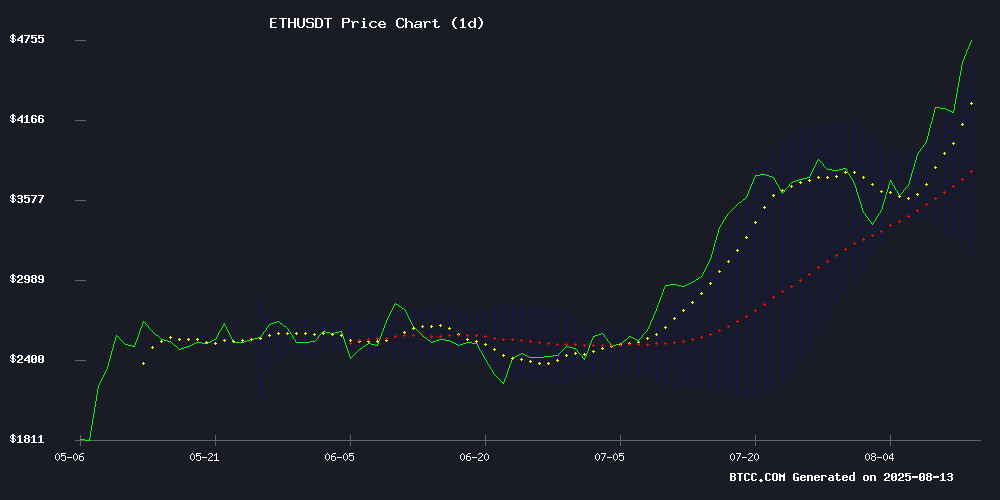

- ETH trading 20% above 20-day MA shows strong momentum

- Institutional demand and ETF inflows driving price discovery

- Analyst price targets ranging from $7,500 to $8,000 create bullish sentiment

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge

ETH is currently trading at $4,671.95, significantly above its 20-day moving average of $3,887.56, indicating strong bullish momentum. The MACD remains negative but shows signs of convergence, suggesting potential upward movement. Bollinger Bands reveal price NEAR the upper band, signaling overbought conditions but also strong buying interest.

Market Sentiment: Institutional Demand Fuels ETH Rally

Ethereum's market sentiment is overwhelmingly bullish, driven by institutional demand, ETF inflows, and positive price targets from analysts. The ethereum Foundation's sale of 5K ETH and whale activity indicate profit-taking but haven't dampened enthusiasm. News of Fed rate cuts potentially pushing ETH to $8K and Standard Chartered's $7,500 target reinforce the bullish narrative.

Factors Influencing ETH’s Price

Ethereum Whale Faces $26M Paper Loss Amid ETH Price Surge; Foundation Sells 5K ETH

A high-leverage Ethereum short position is nearing liquidation as ETH's rally continues. Wallet "0x8c58" opened a 20x short at $2,969 on July 1 via Hyperliquid, now facing $26 million in unrealized losses with liquidation looming at $5,000. The whale has injected over $12 million in additional margin to sustain the position during ETH's 86.8% surge from July lows.

Meanwhile, an Ethereum Foundation-linked wallet sold 5,094 ETH despite the asset's parabolic rise to $4,644 - just 5% below its all-time high. Institutional demand appears to be driving the momentum, with ETH outperforming most major assets this quarter.

ETH Eyes New All-Time High Amid Institutional Demand and ETF Inflows

Ethereum flirts with record territory as institutional accumulation and spot ETF demand propel its rally. The second-largest cryptocurrency now trades at $4,675—a mere 6% shy of its $4,891 peak—after gaining 6.62% in 24 hours. Asian session trading pushed prices to $4,734.45 with volumes surging 25% to $61.58 billion.

Corporate treasuries are vacuuming ETH from markets. BitMine Immersion Technologies seeks regulatory approval for a $24.5 billion share offering to expand its 1 million ETH holdings, targeting 5% of total supply. SharpLink Gaming follows suit, raising $400 million for fresh purchases. This institutional stampede coincides with record inflows into Ethereum spot ETFs, though complete data remains unpublished.

Exclusive: FED Rate Cuts Could Push Ethereum Price to $8K by Year-End, Says Sean Dawson

Sean Dawson, Head of Research at Derive, predicts Ethereum could surge to $8,000 by year-end, driven by anticipated Federal Reserve rate cuts and institutional demand. Speaking exclusively to Coinpedia, Dawson highlighted a 95% probability of a 25-basis-point cut in September, citing labor market weakness as the catalyst.

The real story lies in ETH treasury companies like Bitmine and Ethermachine, which now hold 3.6 million ETH—3% of total supply—up from negligible holdings in April. These vehicles are attracting capital as investors rotate into high-beta assets ahead of expected monetary easing and increased US fiscal spending.

While Layer-2 scaling solutions like Dencun contribute to Ethereum's fundamentals, macroeconomic forces currently dominate price action. The interplay between Fed policy and institutional accumulation creates a bullish setup for ETH as we approach 2025.

Ethereum Surpasses Netflix in Market Capitalization

Ethereum's market cap has eclipsed $566 billion, briefly overtaking traditional finance giants Netflix and Mastercard. The cryptocurrency now ranks as the 22nd largest global asset by valuation, signaling its growing dominance in decentralized finance and digital infrastructure.

Network activity continues to accelerate, driven by expanding Layer 2 adoption and institutional interest. Traders are monitoring whether Ethereum can sustain its position among top-tier assets as DeFi and NFT ecosystems mature.

MEV Protocol Eden Network Announces Shutdown, Treasury Distribution to Token Holders

Eden Network, a blockchain protocol designed to mitigate the adverse effects of maximal extractable value (MEV) in Ethereum transactions, has ceased operations effective immediately. The team cited an inability to maintain competitiveness in the evolving MEV landscape as the primary reason for the shutdown. Remaining treasury funds will be distributed to token holders.

Originally launched as Archer DAO in 2020 to create MEV-based revenue streams for Ethereum miners, the project rebranded to Eden Network following Ethereum's EIP-1559 implementation. The upgrade significantly altered miners' revenue potential, prompting the pivot. Core services including Eden RPC, Bundles, and 0xProtect have been discontinued, with users directed to alternatives like Flashbots Protect and Blocknative Mempool Explorer.

ETH Liquidations Hit $296.55M in 24 Hours

Ethereum traders faced $296.55 million in liquidations over the past day as volatility rocked the market. Forced closures of leveraged positions rippled across exchanges, with short sellers bearing the brunt of the pain. The surge in liquidations underscores the perils of excessive leverage during abrupt price swings.

Bullish momentum exacerbated losses for bears as ETH's price climbed. The scale of the liquidations reflects heightened speculative activity in the derivatives market. Major trading venues saw cascading position closures amid the turbulence.

Standard Chartered Raises Ethereum Price Target to $7,500, Projects $25,000 by 2028

Standard Chartered has sharply revised its Ethereum price targets upward, now forecasting $7,500 by year-end—nearly doubling its previous $4,000 estimate—and $25,000 by 2028. The bullish outlook reflects institutional momentum, with corporate reserve plans targeting $30.4 billion in ETH acquisitions against current holdings of $7.59 billion. Bitmine leads the charge with a $22 billion allocation plan, equivalent to 5% of Ethereum's total supply.

Tokenization trials, stablecoin adoption, and Layer-2 scaling solutions are accelerating Ethereum's utility beyond speculative trading. The bank highlights improved staking liquidity and custody solutions as critical infrastructure for institutional participation. ETH currently trades near $4,636, facing technical resistance at $4,800.

Smaller firms like SharpLink Gaming and BTCS are contributing to the accumulation trend, though their targets pale beside Bitmine's ambitious reserve strategy. Ethereum's evolution into a multi-asset blockchain appears to be reshaping traditional finance's risk calculus.

OZAK AI Investors Eye 700% ROI as Ethereum Approaches ATH

Ozak AI's $OZ token presale enters Phase 4 at $0.005, marking a 400% surge from its initial price. Analysts project a $1 target, implying a 19,900% ROI from current levels. The AI-driven blockchain platform has raised $1.76 million, selling 114 million tokens amid Ethereum's market resurgence.

The project combines predictive analytics with decentralized governance, targeting efficiency in digital asset trading. Phase 5 will increase the token price to $0.01, creating urgency among investors. Its AI engine processes real-time market data to identify trading opportunities.

Is ETH a good investment?

Based on current technicals and market sentiment, ETH appears to be a strong investment:

| Factor | Bullish Indicators | Bearish Risks |

|---|---|---|

| Price Action | 20% above 20-day MA | Overbought on Bollinger |

| Market Sentiment | Institutional demand | Whale selling pressure |

| Fundamentals | ETF inflows | MEV protocol shutdown |

BTCC analyst Olivia notes: 'While short-term pullbacks are possible, the combination of technical strength and fundamental catalysts makes ETH attractive for investors with 6-12 month horizons.'